Now let’s revisit the paper manufacturing company that we have already analyzed before. Here we will take a look at the detailed financials of the company and do a pro-bono consulting work for its management. Our primary goal is to provide a few suggestions to the management team on future improvements, but not only that, we also want to provide support to creditors and shareholders and help them evaluate their investments into the company.

Background

If you recall, the year we did the analysis was 2002. In this episode, we want to discuss the situation two years later, or 2004. By 2004, this company had been operational in its industry for more than 10 years. When this company initially entered the industry, it upgraded some products by acquiring advanced technologies. This way, it obtained a foothold in the industry relatively quickly.

The company subsequently decided to focus on the following tactics. First, it seeks rapid expansion via mergers and acquisitions. Through agressive M&A activities and direct investments, the company quickly became the largest company in terms of production capacity in the industry. Second, the company also decided to actively explore international markets in addition to the domestic markets that it’s already in. Last but not least, the company also developed a wide range of products.

Our target company, throught its business decisions and executions, became the largest paper manufacturing company in the industry. To gain a fair understanding of the company’s performance, it’s only logical to compare it with the second largest company instead of the industry average. The comparison company actually has some huge differences from this company. The most noticeable difference is that this company has a homogeneous product line with relatively few selections. Later, we will show how the product lines of these two companies are constituted.

In addition, the target company invests in various aspects of the industry such as raw materials. In previous discussions of the paper manufacturing industry, we mentioned that the supply of raw materials in China is relatively short because of limited forestry resources in the country, and many raw materials such as wood pulp and waste paper pulp need to be imported.

The company actively explores various sources of raw materials. On one hand, it built many raw material production bases, including a 30,000-ton reed pulp base, a 50,000-ton wood pulp base, and a 50,000-ton poplar wood pulp base. On the other hand, it also cultivated a 666.7 square kilometers poplar forestry. In other words, the company actively attempts to solve the raw materials shortage problem by planting trees and boosting its pulp production capacities. Later it also took over another company with an annual production capacity of 300,000 tons of pulp.

In summary, the target company engaged in numerous business activities in the past few years, activities such as large-scale expansions, mergers and acquisitions, product line expansions, and vertical integration, i.e. building production bases of raw materials. Although the company is rapidly expanding its scale in the market and constructing its production bases, the company’s financial data is not very optimistic. Let’s take a look.

We already know that the primary benchmark to evaluate a company is its ROI, specifically, the return on total assets. The target company only has a 3% ROA, a number even lower than bank’s deposit interests. Therefore, without making further calculations, we know that the company’s return on investment is below its cost of capital.

The company that we compare our target company with has a 7% return on total asset, even though this company is only regional. Clearly, the target company lags behind significantly in terms of return on investment.

Why, exactly, is its return on investment so far behind that of its competitor?

Cost Analysis

Although the company is quickly developing in the market, its financial data are not optimistic. The company’s return on investment is only 3%, which is far behind the 7% return enjoyed by its opponent. What is the reason for this situation? We know that return on investment is determined by two factors. One is the company’s effectiveness and the other is the company’s efficiency.

First, we will examine effectiveness. The net profit ratio of our target company is 7%, whereas that of its competitor is 10%. It is clear that our company’s effectiveness lags behind that of its competitor.

Next, we will examine efficiency. The company’s total asset turnover ratio is 0.45, whereas its competitor’s is 0.7. It is clear that from the perspective of efficiency, this company also lags behind the competitor. From our previous lessons, we know that a company will normally make trade-offs between effectiveness and efficiency when setting its overall strategy. However, for this company, what we see is that both effectiveness and efficiency lag behind. A lagging effectiveness plus a lagging efficiency has caused a less satisfying return on total assets for the target company. Therefore, the next step is to find out why this has happened.

Let us first look at the effectiveness. We know that the most important factors that determine a company’s net profit ratio are costs and expenses. This is the company’s cost and three of its expenses in 2004. Specifically, we want to examine the proportions of operating expense, management expense, and financial expense relative to its revenue.

First of all, we will examine cost. We find that from the perspective of costs, there is no difference between the company and its competitor; the costs of our target company and those of its competitor are both 76%. This figure seems to indicate that the problem of the company’s poor effectiveness is due to higher expenses rather than costs. However, this may not be the case.

If you recall, the paper manufacturing industry is highly capital intensive and requires a great deal of fixed asset investments. Theses fixed asset investments mainly involve equipment, meaning that the company’s production costs contain relatively more fixed costs. When a company’s production cost contains costs that are relatively more fixed, economy of scale exists. An industry with economy of scale will see a decreasing unit cost of fixed assets with the increase of production. The more products are produced, the lower the unit cost of fixed assets.

Now let’s examine the production capacity of these two companies.

We can see that production capacity is approximately 1.5 million tons for the target company and approximately half a million tons for the competitor. That is, the production capacity of the company is approximately three times that of its competitor. Knowing this, it is nature to assume that the target company will have economy of scale over its competitor simply because of its size. Our target company SHOULD have a cost advantage.

However, for a company with production capacity three times that of its competitor, we actually don’t see the expected cost advantage, which is reflected in the equal percentages of cost over revenue for both companies.

So, what could be the problem?

Let’s further examine the product lines of these two companies. From the table above, we can clearly see that the target company’s product line is much more diverse than its competitor’s. Its products include writing and printing paper, newsprint paper, and cardboard paper. With respect to the writing and printing paper, the company also makes different products, including light-weight coated paper, offset paper, writing paper and art paper. Its competitor only produces two types of paper: newsprint and cultural paper. In addition to the company’s diverse product lines, the size of each product line is actually not very large. Among the various products, we see that only art paper is relatively large with a similar size of the competitor’s newsprint product line.

The paper manufacturing industry has an important feature: each line of product needs a specific set of equipment, which can only produce this specific type of product. Logically, the economy of scale cannot be achieved by a bigger company size, and can only be achieved by a bigger product volume for that specific type of product.

By now we should be able to understand why the company failed to achieve a lower cost structure despite of its size. Even though the company’s production capacity is three times as large as its competitor, it actually achieved such capacity via product line expansion, and no single product’s volume is significant enough to achieve true economy of scale. This is the reason why the target company does not have a cost advantage over its competitor in this capital-intensive industry.

This table lists the cost structure for producing one ton of paper in different regions of the world. In China, the cost structure of paper manufacturing is relatively special. China has a distinct advantage in labor cost, and a disadvantage in the cost of raw materials. For a paper manufacturing company, this means that in addition to fixed costs, costs of raw materials also make a material impact to its cost structure.

Our target company has been building raw material production bases and cultivating forestry for some time. It not only has built and acquired production bases, but has also planted trees on a very large scale. The company has done quite a lot of work to combat the shortage of raw materials. The company should have exhibited a clear cost advantage after all the work.

Yet from our discussions above, we know this is not the case. The reason is actually quite simple; although the company actively builds raw material bases, trees will take considerable amounts of time to grow to maturity, after which trees will have to be harvested and processed into pulp. It will likely take quite some more time before all the vertical integration efforts can be reflected in the company’s costs.

On the other hand, how does the competitor perform? This competitor has two primary products, newsprint paper and cultural paper. Newsprint paper is usually not produced from wood pulp but from reed, and there are abundant reed resources in the local region. The competitor has been able to utilize such local resources to maintain a reasonable raw material cost.

In summary, our target company has engaged in a great deal of vertical integration; it vigorously plants trees, develops pulp bases and acquires production capacity. Its competitor, on the other hand, solves the problem of insufficient raw materials by using alternative raw materials. They also differ in their product line strategies. Our target company has a multi-line strategy, further diluting its chance to achieve economy of scale, while the competitor has a much narrower selection of products.

Expense Analysis

Let’s revisit this table illustrating all the costs and expenses. In this table, we also list the proportion of each expense relative to revenues. Clearly percentage wise, all three expenses of the the target company are higher than those of its competitor.

Let’s start with financial expenses.

Financial Expenses

Clearly the target company has more debt financing than it competitor does. This company has taken out both short and long term loans, and has also issued bonds. Overall, all of the company’s interest-bearing liabilities account for 44% of its total assets, whereas the same categories of liabilities only acount for 19% for the competitor. Because the company has more interest-bearing liabilities, its financial expense is significantly higher than that of the competitor.

Here we see that to support a production capacity approximately three times as large as that of the competitor, the company needs to invest more in this capital-intensive industry, where a production capacity of approximately 10,000 tons requires an investment of 100 million CNY. Considering that the target company has 1 million ton more capacity than the competitor, it likely has invested 10 billion CNY more than the latter. Such a huge amount of investment is likely the reason why the target company has to resort to debt financing more than the competitor does.

Operating Expenses

Operating expenses include expenses related to sales activities such as advertising, salary of sales team, commissions and bonuses, as well as freight and storage fees incurred during the sales process.

As part of its expansion strategy, the target company established many sales subsidiaries located across the country, covering most of its major markets.

From this table, we can see that over 38% of the company’s sales are from eastern China, followed by northern China. The markets in these two areas account for 60% of the company’s total revenue. The raw material bases, on the other hand, are primarily concentrated in northeast China and Inner Mongolia, creating a major mismatch between its own supply and demand. So even though the target company established a great deal of production capacity, such capacity are NOT located in the company’s major markets. The company has to spend a great deal of resources to transport raw materials to production bases, and from production bases to major markets. As a matter of fact, transportation accounts for 75% of all operating expenses, or about 4% of the company’s revenue.

Management Expenses

Management expenses, or administrative expenses, account for about 5% of revenue, higher than the 3% of its competitor.

The reason is that in the past several years, the company engaged in many mergers and acquisitions, gradually becoming the largest integrator in the industry. When a company acquires another company, it not only acquires its physical assets, but it also takes in that company’s personnel. The success of any M&A depends largely on whether the personnel of the acquired company can successfully integrate with the buyer. Even for many well-known companies, such integration could be extremely challenging, which can cause the failure of an otherwise successful M&A deal.

This could be a major reason why the target company has a higher administrative expense. Before the company can achieve actual integration after the M&A deal, the company might have a higher administrative expense than its competitor.

Turnover Analysis

Analyses of cost and expenses are from the aspects of effectiveness. Now let’s move on to efficiency.

It is apparent that the company also lags behind its competitor on efficiency; its total asset turnover ratio is only 0.45, while that of its competitor is 0.7. To know why the company’s total asset turnover ratio is lower than that of its competitor, first we must understand what are the company’s largest assets, and what the turnover ratio of those assets are like.

First, we want to know what the company’s largest assets are. A simple way to do this is to conduct a common-size analysis on the balance sheet.

Through common size analysis, we will be able to know a company’s asset structure, which leads us to the company’s largest assets. Upon locating these assets, we then identify those that contribute the most to a company’s low asset turnover ratio. The reason is that the total asset turnover ratio is actually determined by the weighted average of turnover ratio of each asset item, where the weight is the proportion of an asset item relative to the total asset. Therefore, our first step is to identify the structure of a company’s assets.

In this common-size analysis, we can easily see that fixed assets are the company’s largest, accounting for 65% of the company’s total assets. Its competitor also exhibits this type of feature, where its fixed assets account for 70% of the competitor’s total assets. Both companies have exhibited the capital intensity of the paper manufacturing industry. Other than fixed assets, both companies have similar levels of accounts receivable and inventory. These three assets alone, for both our target company and its competitor, account for more than 80% of total assets. In other words, if we can understand the differences between the turnover ratios of these three assets between the two companies, we should be able to find out why our target company has a lower total asset turnover ratio.

Fixed Asset Turnover Ratio

Fixed assets are further divided into two parts, finished fixed assets and construction in progress. Even though our target company has a lower level of fixed assets than that of its competitor, it actually has more construction in progress. 28% of the 65% of fixed assets are actually construction in progress, while its competitor only has 14% out of the 70%.

Why does this matter? Well, we know that fixed assets under construction can not be put to use. Therefore, it is impossible for them to generate revenue for the company. However, they still need to be accounted for in fixed assets; so construction in progress are essentially fixed assets with ZERO turnover, since they generate ZERO revenue. This is a major reason why the target company’s turnover lags behind.

Inventory

Next let’s look at inventory of both companies.

We find that the company’s inventory turnover ratio also lags behind its competitor. Why is that? Let us look at the types of inventory involved.

On this table, we see that inventory can be divided into two categories, raw material and finished goods. The largest portion of inventory for the target company is not finished goods, but raw material.Furthermore, relative to the previous year, there was a substantial growth in raw materials within just one year, increasing by more than 400 million CNY. Clearly, our target company was hoarding raw materials.

Why was it hoarding raw materials? Well because of the shortage of raw materials, prices of raw materials are almost always rising. The company could be hoarding just to prevent price fluctuations. But since raw materials cannot generate revenue before they are further processed, they will drag down the overall inventory turnover ratio.

Accounts Receivable

The target company’s accounts receivable ratio is actually not bad, even though it is still lower than that of the competitor. There could be some factors such as that the company might have adopted loose credit sales policies in order to move products faster. Another reason might be because the company has a wider variety of products.

However, will its more accounts receivable, coupled with a relatively lower accounts receivable turnover ratio, bring higher risk to the company? Let us look at the company’s account receivables.

For the year 2004, 85% of the company’s accounts receivable were likely within a year old. From this perspective, we believe that the company’s accounts receivable are relatively safe.

This is our analysis of the company’s turnover ratio. There are mainly two reasons why the company lags behind its competitor in efficiency:

- The company has more projects under construction, and is at a stage of rapid expansion.

- The company is taking measures to reserve raw materials, which will result in a relatively low inventory turnover ratio.

Recap of the Target Company’s Current Status

Reasons the Target Company Lags on Effectiveness

Our target company lags behind its competitor on both effectiveness and efficiency, even though it is much larger in terms of production capacity.

We find that the company lags behind the competitor on effectiveness for the following reasons:

- As a large-scale paper manufacturer, the company does not enjoy the cost advantage that should be present in an industry with economies of scale. This is primarily because this company adopts a multi-product strategy, none of which has a significant scale.

- Over the past several years, this company has started building production bases of raw materials, including planting trees and acquiring pulp production capacities. Planting trees, a slow process by itself, will not yield an effect on the company’s costs within a short period of time.

- The company’s relatively large scale results in a very high financing requirement in this capital-intensive industry, causing high financial expenses.

- The company’s raw materials, production bases, and major markets are not located in the same region, forcing it to pay high transportation fees, which is a type of operational expenses.

- The company’s rapid mergers and acquisitions during the past several years also pose great challenges to company management, and whether the company can effectively integrate its acquired companies is still unknown, potentially causing higher administrative expenses for the comapny.

Reasons the Target Company Lags on Efficiency

Unfortunately, the target company also lags behind it competitor on efficiency, for the following reasons:

- The target company have many fixed assets under construction and these projects do not generate revenue, lowering the fixed asset turnover ratio.

- The target company has been engaging in hoarding raw materials, more than doubling the total inventory within a year. However, raw materials cannot generate revenue while they are only stored in warehouses, thus lowering the inventory turnover ratio.

Judgment for the Company’s Future

What do you think of the target company’s future after knowing everything?

To help you with the judgment, let’s first examine the market environment. We know that China’s paper manufacturing industry was growing fast up until 2008, after which the industry transitioned into a stage of excess capacity. The year of 2004 was only four years away from 2008, meaning that companies in the paper manufacturing industry had four years to prepare for such a highly competitive environment.

Another dynamics that was always present was the shortage of raw materials, and companies would have to rely on imports. Consequently, the price of raw materials was always rising.

Other than exisitng competitions from the industry, companies in the industry also face the threat of substitute products.

Do paper products have potential replacements? Well, it depends on the exact type of paper we are discussing. For example, household and packaging paper are unlikely to be replaced. Even though we can use non-paper wrappers as replacements for packaging paper, the general trend of packaging paper consumptions is still moving up with the level of economic development.

Newsprint paper and writing and printing paper are facing quite different situations. Over the past two years, paperless reading on devices such as iPad, Amazon Kindle, and smart phone has become increasingly popular. The popularity of these items has caused a large reduction in paper-based media. In particular, newspapers and magazines are impacted the most.

Knowing the general market trend and environment, we might see things differently for the company’s multi-product strategy. Even though the target company wasn’t able to achieve economy of scale as a result of its multi-product strategy, it might be in a better position to deal with changes in the market. For example, the possibility of demands of all of its products going down at the same time is fairly rare. In contrast, the main products of its competitor, newsprint and cultural paper, are most seriously impacted by paperless reading, rendering it less prepared to face future market changes.

In addition, even though the target company’s vertical integration activities have not yielded cost advantages for the time being, the raw material bases and self-planted forestry will msot likely play a role in the future. The competitor, though not worrying about the high fixed costs at this moment by adopting the alternative approach of using reed pulp, will not be worry-free. Since paper manufacturing from reed pulp pollutes heavily, a more strict environment protection requirement could render such method cost-prohibitive.

A company’s lack of cost advantage may not be fatal when competition is not fierce. For example, when the average gross profit ratio is 30%, a 5% higher than average cost will cause reduce a company’s gross profit ratio to 25%, which is not life or death. However, when the overall industry competition becomes more and more fierce to the point where the industry’s average gross profit ratio is 15% or lower, a 5% difference could make a huge differece. As the industry becomes more and more competitive, we can expect cost to play an ever increasingly more important role in industry dynamics.

Our target company has not only built raw material production bases but has also reserved raw materials, so it’s ready to face the fluctuation of raw material prices. However, the size of its production capacity naturally requires the company to always be prepared to raise more capital. Additionally, the company’s production, supply, and markets do not match, so it urgently needs to correct such mismatches. And it will need more time to digest the extra administrative expenses caused by its merger and acquisition activities.

The low turnover ratio of fixed assets is primarily because the company is now at the expansion and construction stage and has many projects in progress, which cannot generate revenue until they are finished. As these projects in progress are gradually completed, the turnover ratio of fixed assets will return to a normal level.

The company’s inventory turnover ratio is relatively low due to its hoarding of raw materials. However, hoarding of raw materials might provide the necessary cost effectiveness in the future. So from the perspective of future development, this company is not in a bad situation.

On the surface we might be inclined to conclude that the target company is in trouble in the year of 2004; but after our in-depth analysis, we have found that there are still many things to anticipate for the target company. Its many past measures have laid a good foundation for its future, although its management still faces many challenges.

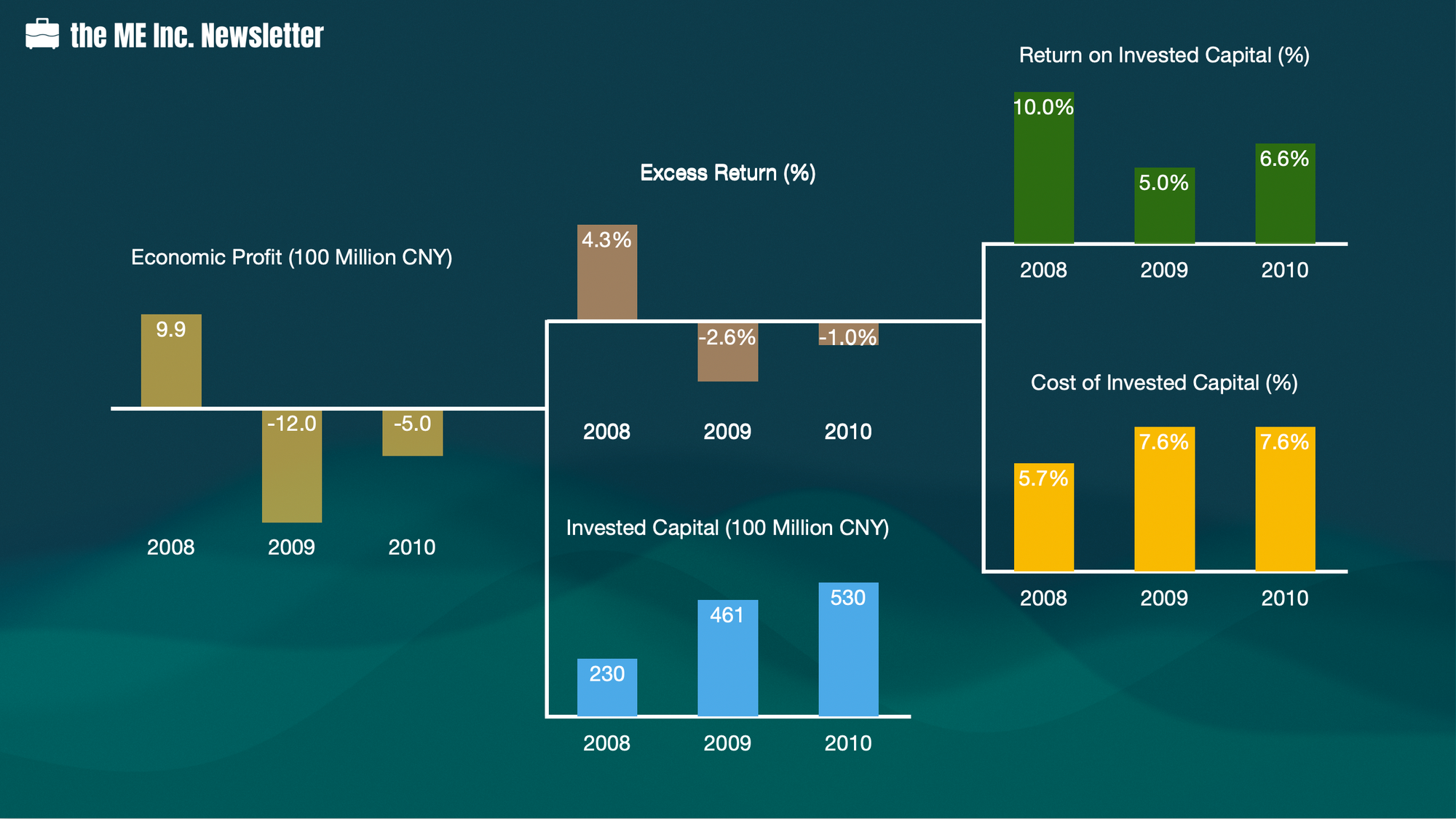

Let’s look at the financial data of the two companies in 2008.

Recall that 2008 was the year for the Chinese paper manufacturing industry to enter excess capacity; competition began to emerge. Clearly, we see that after four years, all of the target company’s the financial indices have significantly improved. This result is consistent with our previous analysis. In addition, we have just mentioned that the competitor might have a problem that its primary product, newsprint, could suffer from the ever more popular trend of paperless reading. Moreover, since the competitor does not have considerable reserves of raw materials, its costs are more susceptible to increase.

Three years after 2008, or 2011, the fierce competition has rendered the competitive environment totally different for the two companies. The competitor’s net profit ratio in 2011 dropped to only 0.7%, at the brink of loss.

The target company has a gross profit ratio of 16%, 4% higher than that of its competitor. In a highly competitive industry like paper manufacturing, 4% could make a huge difference on the life or death of a company. It is also because of this difference, the target company still turned in a relatively good performance. The subsequent development of the company is consistent with some of our previous judgments.