The three financial statements – balance sheet, income statement, and cash flow statement – reflect two perspectives. The first perspective is what the cash flow statement reflects, which is whether a company can sustain its business in the future, or its risk. The second perspective is what the combination of balance sheet and income statement represent: if the company can sustain its business, what the business will look like. In other words, it is the perspective of returns.

In our previous discussions of the paper manufacturers, we were actually assuming there were no operational risks, meaning that we assumed that these companies had no survival risks. However, we know that this is not true in the real world, so we will discuss the analysis of cash flow statement and learn how to understand the information on cash flow statement.

First of all, let’s recall what cash flow statement looks like. As we said, the cash flow statement describes the flow of cash. It is related to three types of activities of a company, or operation, investment, and financing. Under these three types of activities, the statement describes the inflow and outflow of cash. We have covered the detailed concepts of each type of cash flow in a previous episode which can be found here.

For the cash flow statement, the ultimate net cash flow is the total cash inflow minus the total cash outflow.

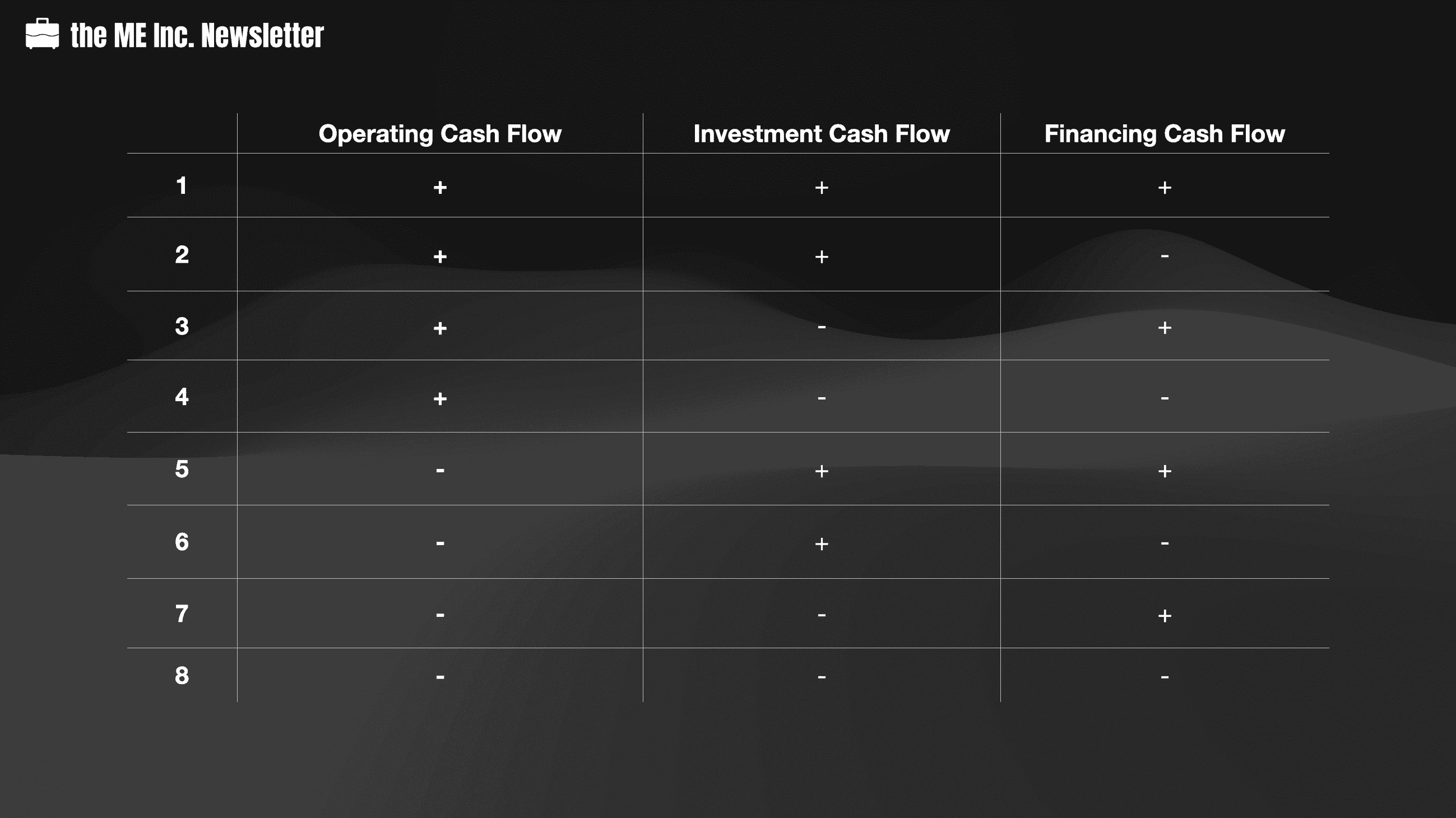

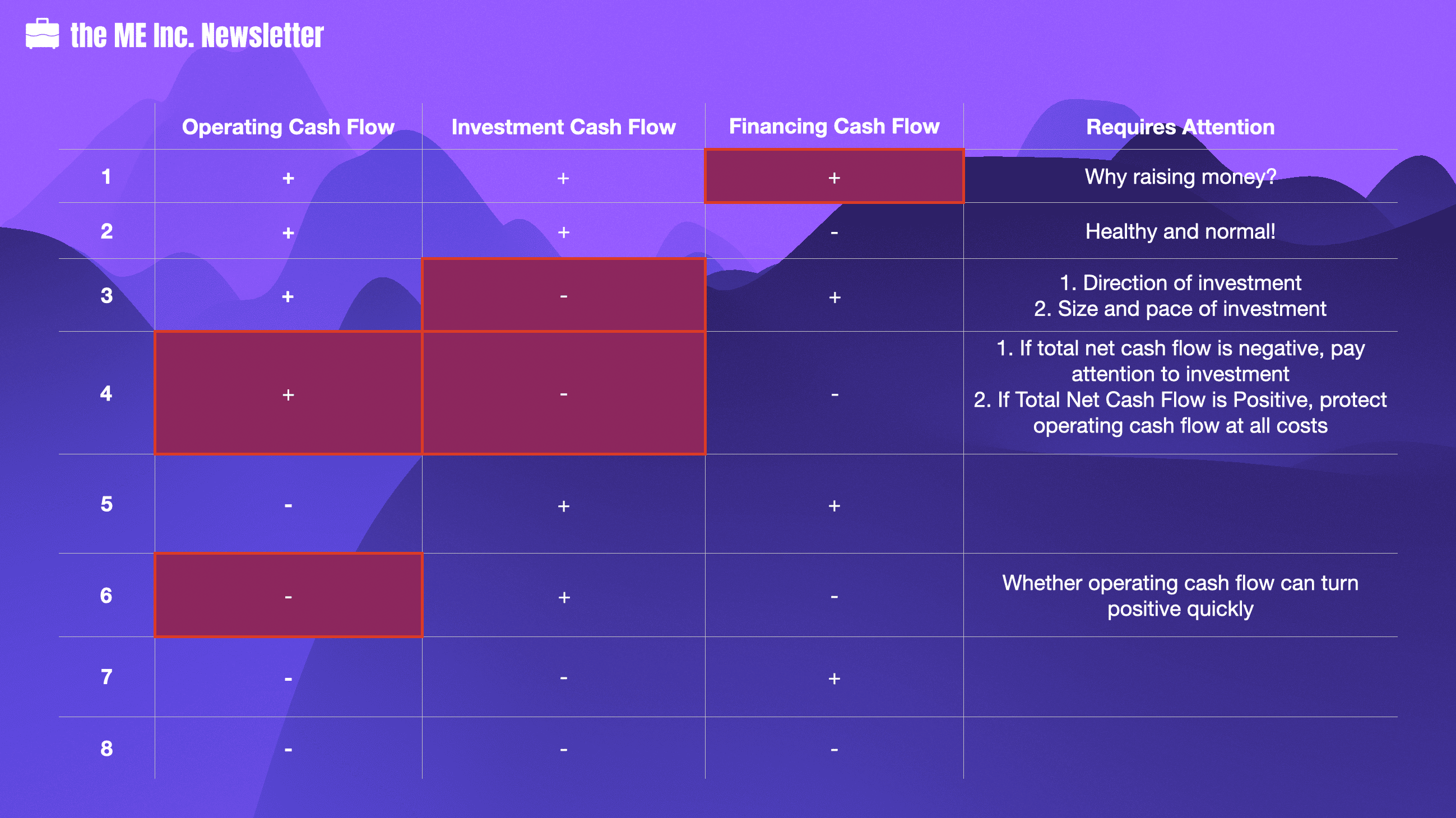

This table illustrates the possible combinations of a company’s net cash flows for each type of economic activity.

Recall that the reason we want to understand the detailed changes for each type of economic activity is that the final net cash flow of the company is not that important; after all, we can get the same number from the balance sheet alone, i.e. by looking at the cash balance difference between last year and this year. In short, we want to understand the reason for a company’s cash outflow and inflow. So let’s discuss how to interpret components in the cash flow statement.

For each type of cash flow, the net result could either be a net inflow or a net outflow. A net inflow is represented by a plus sign, while a net outflow is represented by a minus sign. All possible combinations are documented in the table above. Now let’s discuss them one by one (not necessarily from the first to the last).

2nd Combination: + Operating Cash Flow, + Investment Cash Flow, – Financing Cash Flow

Let’s first look at the second combination. What does a company that has a positive operating cash flow, a positive investment cash flow, and a negative financing cash flow look like?

+ Operating Cash Flow

Having a positive operating cash flow means the money earned from selling products is enough to cover for its procurement, wages and taxes, etc. In other words, the company’s operating activities are self-sufficient, or it can generate blood for itself.

+ Investment Cash Flow

We see the cash flow of investment of the company is positive. What this means is that the company has net cash inflow from investment.

A company may generate positive investment cash flow from disposal of asset or cash from returns of investment. Generally speaking, it is more likely that such cash comes from returns of investment, considering that the operating activities of the company is also generating positive cash flow itself, so it should not need to dispose of its assets.

– Financing Cash Flow

The company’s financing activities are generating negative cash flow for the reason that the company may be paying back money to banks, or paying dividends to shareholders.

Summary

In short, the company’s cash flow is healthy and normal. The company’s operating activities are quite healthy. Its investment has made some returns, and this company spends some money on paying loans to banks or paying dividends to shareholders. The company might be in a mature stage.

1st Combination: + Operating Cash Flow, + Investment Cash Flow, + Financing Cash Flow

The only difference between the first and the second combination is that the first combination has a positive financing cash flow.

What this means is that the company is taking in financing money, or raising money.

Why should a mature, healthy company with normal operations be raising money? And where could the company spend such money?

One possibility is that the company plans to invest in a certain area, so it needs money. But if we look at this company, the company actually has a positive investment cash flow. What it means is that at least at this stage, the company hasn’t made large-scale investments, which will cause large cash outflows. As soon as the company starts to make such large investments, its investment cash flow will turn from positive to negative, which is represented in the third combination.

But what if the company has no such investment plans? Why should such a mature company be financing? If it doesn’t have a big plan of investment, there is no reason that it should need more money.

In reality, however, companies do raise money even when they don’t have investment plans. The reason could be multifaceted. For example, in China private companies’ financing methods are quite limited. So when a company is running smoothly and has enough money, it actually is in a better position to get loans from banks. The company will seize such opportunity to secure as much loans from the banks as possible, since such opportunity is hard to encounter. Of course, we cannot rule out the possibility that some companies have bad motives when raising money without specific investment options. For example, it may want to transfer such money to some affiliated companies.

Overall, a company with positive cash flows in all three types of economic activities requires more attention. We should at least ask the purpose of it financing, and how the company expects such financing to impact the future of the company. Regardless of whether the company is raising money because its financing channels are limited, or because it has ill reasons, such financing activity will dilute the profitability of the company.

3rd Combination: + Operating Cash Flow, – Investment Cash Flow, + Financing Cash Flow

Like we said, the company with the 1st combination of cash flows could soon become one with the third after it executes on its investment plan. The company’s operating activities are completely self-sufficient; at the same time, it needs more money for investment.

What do you think is the biggest concern of this company?

Investment. Why?

Well this company is likely using money from operating and financing activities for investment. The success of investment could literally make or break this company. There have been numerous cases where a healthy and successful company goes into bankruptcy because of just one investment failure.

The first thing off the top of our minds is when a company decides to invest in unrelated businesses, fails, and never recovers from such failure. However, even when a company stays in its main business and invest, the success of investments is no guarantee. For instance, there was a very famous company in the instant noodle business. This company created the concept of non-fried instant noodles, which are thought of as more healthy. Because of such a healthy concept, the company quickly became one of the five largest instant noodle makers in China.

To maintain such level of success, the company began to invest heavily in production capacity expansions. Its investment was made in its main business, not diversified lines of businesses. Considering that its main business is going so well, such investment can actually be considered as low-risk.

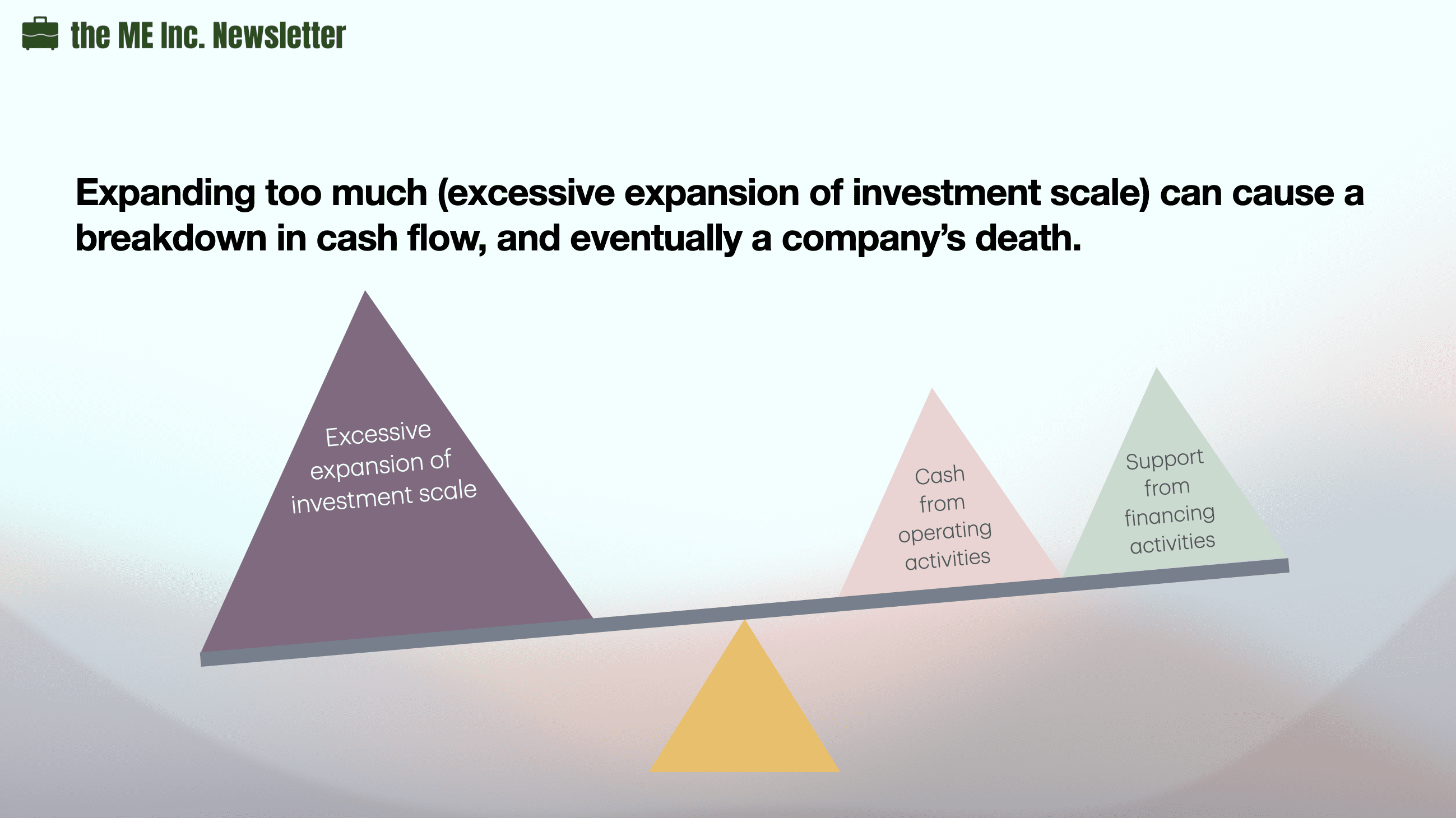

However, the final result was pretty sad. When the company went bankrupt because of a breakdown of cash flow, there was only 3,000 CNY in its bank account. Apparently the company’s cash flow completely broke down. How could such a situation happen?

As a matter of fact, even when the company went bankrupt, its main line of business was still doing quite well. Its market share was well maintained, and the accounts receivable were still being collected. Then why does such a company end up like this?

The reason is quite simple. The company expanded too fast by putting too much cash into investments. We know that investments will take time before they can generate returns. Before that, there is only cash outflow. Such cash outflow relies on cash flow from its own operating activities and its financing capability. If its investment expands too fast, it may lead to a situation where both operating and financing cannot generate enough cash to support such investment. The rapid outflow of cash could lead to a shortage of cash, and even drive an otherwise promising company into bankruptcy.

Therefore for a company with positive operating cash flow, negative investment cash flow, and positive financing cash flow, we should pay special attention to the company’s risk of investment. Such risk not only lies in the direction of investment, but also in how to effectively control the size and pace of the investment so that the company’s cash reserve can be kept within a reasonable range.

4th Combination: + Operating Cash Flow, – Investment Cash Flow, – Financing Cash Flow

There is only one combination between the 4th and the 3rd combination, which is that this combination has a negative financing cash flow. In this case, the company is still paying back money.

Compared to a company with the 3rd type of cash flow, do you think this company has a higher or lower risk?

Well, it could go either way. It might have a higher risk because it has more areas to invest, in addition to paying back dividends or loan interests. It might have a lower risk, considering that it is already controling its leverage by paying back interests.

However, let’s think from the aspect of net cash flow.

If Total Net Cash Flow is Negative, Pay Attention to Investment

If at this moment, the company has a negative net cash flow, it means its cash is decreasing. Because an othewise healthy company can be driven to the edge of bankruptcy by cash flow breakdown, we should pay special attention to whether the company’s investments are growing too large too fast.

If Total Net Cash Flow is Positive, It’s All Good…(for the time being)

If its current net cash flow is positive, it means that the risk is kept within controllable range. Because cash flow from operating activities is the most reliable and stable source of cash, we rely on operating activities to support its investment and financing activities. And since there is extra cash, this company has the means to keep its risk under control.

But is operating activity reliable and stable forever? Well, not necessarily.

In 2008, China’s real estate market experienced such a change. In 2007, the whole market was booming, as the housing prices increased significantly. Despite the soaring price, there was still huge demand, and whenever a new apartment came onto market for sale, it sold out instantaneously.

In 2008, the real estate market suddenly cooled down after the global financial crisis happened. The whole process lasted for less than one and a half year. During this time, most real estate companies experienced slow sales, so their operating activities were negatively affected. The worst case scenario is that cash flow from the operating activities would become negative, and once they do, situations 1, 2, 3, and 4 will become situations 5, 6, 7, and 8.

8th Combination: – Operating Cash Flow, – Investment Cash Flow, – Financing Cash Flow

In situations 5 to 8, which one is the worst?

Obviously, it is the last situation, where a company has a negative cash flow for all three types of economic activities. A company in such a situation will have only outflows of cash. If nothing changes, the company will eventually run out of money and go bankrupt.

A company with this combination of cash flow actually evolves from the 4th situation, where only operating cash flow was positive.

We mentioned that if the company with all negative cash flow in three types of economic activities doesn’t change anything, its cash will eventually run out and the company will be closed. But what kind of changes can it make?

The first option is to turn cash flow of operating activities to positive, or come back to the 4th Combination of cash flow.

The second option is to turn cash flow of investment activities to positive, or the 6th Combination of cash flow.

The third option is to turn the cash flow of financing activities to positive, or the 7th Combination of cash flow.

However, we know the 6th combination is hard to achieve. What this option shows is that even though I’m still making investments, these investments can quickly generate returns, which is a feat very difficult to achieve. A plausible way to achieve this is to sell these investments, which is the last outcome we want to see unless there are no other options.

From 8th to 4th: Turning Operating Cash Flow Positive Again

Then can we go from the 8th to the 4th option, i.e. at least turning our operating cash flow into positive?

Let’s revisit the real estate market downturn in China during the global financial crisis around 2008. During that time, many real estate companies started to heavily discount the houses they built, sometimes to as high as 30% off. The reason is that these companies wanted to collect cash as fast as possible in order to counter their shortage of cash, even at the cost of profitability. But it was only with such drastic discount methods that some real estate companies were able to turn their operating cash flow back to positive, saving them from bankruptcy.

Now that the company has managed to get out of the all negative cash flow situation and at least managed to return to a positive operating cash flow, its operating activities have become the main source of risk. Though we mentioned that its investment activities would still need to be monitored so investments wouldn’t grow too big too fast, the company should definitely protect its operating cash flow at all costs, as this is the only healthy cash flow it has. Without it, the financial situation of the company will soon enter into a downward spiral.

From 8th to 7th: Turning Financing Cash Flow Positive Again

How can it change to situation 7? To do this, we need to finance.

But during that period of time, the Chinese government launched a policy aiming at cooling down the real estate market, preventing banks from giving out loans to real estate companies for development. What this means is that if a real estate company wants to develop a new project, it won’t be able to secure any loans from the banks during that time.

To make matters worse, the China Securities Regulatory Commission also set forth a regulation preventing all real estate companies from going public during a specific period of time. Real estate companies lost all financing channels, either from equity of from debt.

To survive, some real estate companies started to borrow money from non-bank financial institutions such as some trust companies at much higher interest rates. This just shows how desperate some real estate companies were at the time, doing anything they can just to survive, even bearing the extra cost of capital. Of course, this ordeal didn’t last long, and after one year the real estate market became hot again. Although some companies went bankrupt, most of the companies overcame the difficulties after putting in all the efforts. However, we can easily imagine an otherwise different outcome; if the period dragged longer, many companies would need to start selling off their investments. If even after selling off investments, the companies still were unable to come up with enough cash, some might resort to bankruptcy.

As a matter of fact, in 2024 we indeed saw this happen, albeit 15 years later. Most real estate companies have encountered financial troubles, from Evergrande, Vanke, Wanda, Shimao, just to name a few. Evergrande has entered the bankruptcy process.

7th Combination: – Operating Cash Flow, – Investment Cash Flow, + Financing Cash Flow

One major difference between 1 to 4 and 5 to 8 is that the first four combinations have positive operating cash flows. For companies with negative operating cash flows, what do you think would be the stage of lifecycle these companies are in?

Generally speaking, companies in the startup stage are more likely to have a negative operating cash flow. As these startups are still developing products and looking for product market fit, they are more likely to spend more than they make. Another possible scenario is when the market enters into recession. During this period of time, competition becomes so fierce that products just don’t sell.

Let’s first look at startups.

If a startup’s cash flow from operating activities is negative, how about its cash flow from investment? We all know that a start-up company needs to keep investing to grow bigger. After a startup makes investments, its investment cash flow should become negative.

If its cash flows from operating and investment are both negative, how can the company survive? Apparently, it needs financing, i.e. its financing cash flow is positive. This means a startup company normally has the seventh type of cash flow.

5th Combination: – Operating Cash Flow, + Investment Cash Flow, + Financing Cash Flow

A company with this type of cash flow combination is likely one that has earned a large sum of money in the past and has a large cash position. Even though this company’s operating activities are not generating positive cash flows, the company’s past investments are generating positive cash flow, and it can consistently bring in money from the financial market. This company has a strong capacity in mobilizing capital from the financial market.

6th Combination: – Operating Cash Flow, + Investment Cash Flow, – Financing Cash Flow

There are normally two possibilities for companies with this type of cash flow combination. The first possibility is that this company has a good investment project that is generating cash flow. In fact this project is so lucrative that it has enough returns to carry the company. Another possibility, rather an unfortunate one, is that the company is selling off projects. A company facing the second possibility is running out of cash and will likely close doors soon.

We can see that this situation rarely happens.

For this type of company, the key point is whether the company’s operating cash flow can become positive in a short time. When its operating cash flow becomes positive, the 6th combination will become the 2nd.

Leave a Reply