In the previous episode, we looked at a company’s capacity to repay short term debts. Next let’s look at how to evaluate a company’s capacity to repay long term debts.

If you recall, we measure the capacity to pay back short term debts by dividing current assets by current liabilities. In this sense, it seems plausible that we should divide long term asset by long term liabilities to measure the capacity to repay long term debts.

Wrong. Big time wrong.

When we do calculate the capacity to pay back short term debts, we assume that all our current assets will turn into cash instantly, i.e. getting liquidated, so we can pay with such cash from the current assets after liquidation.

But if we do the same for long term debts, what would happen?

Long-term assets consist of non-current assets such as fixed assets, intangible assets, and long-term investments, etc. If we cash out long-term assets, meaning that we will sell all subsidiary companies, manufacturing plants, properties and equipment, etc., do you consider this an act to pay back long-term debt?

Not at all. The company is about to close doors and cease operations. So the assumption is wrong.

Long-term Solvency

Long-term liabilities usually consist of two parts: one is interest payment and the other one is principal payment. Let’s talk about interest payment first.

Long-term debt interest repayment

How will the company pay interest to its debt? Naturally, you may considering paying back the bank from money we earn, which is net profit of the company. It seems that we should divide the net profit by interests to see if profit can cover interest.

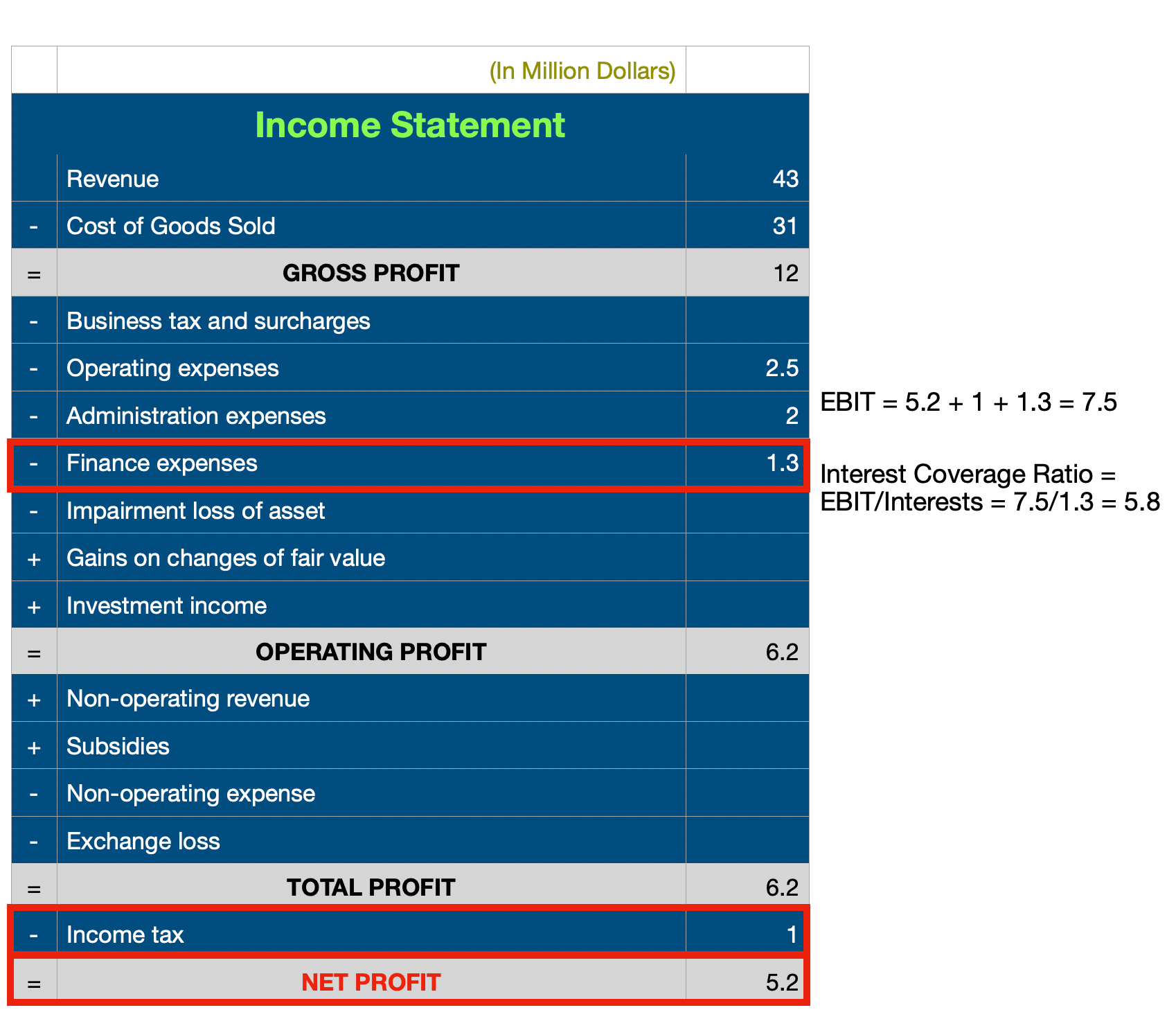

However, this ratio will not be found anywhere. If you recall on the income statement, there is one item called financial expenses which refer to interest payment. In other words, bank interests are actually paid BEFORE we get to net profit. If we use the above method of dividing net profit by interests, we will have paid the interest twice, which doesn’t make any sense.

Which number should we use then? We’ve already understood that we should use the number before we pay the interests, so let’s start from there.

Since we know the net profit, it is easy to understand that net profit plus interest is the money I earn before paying the interests. However, there is one more thing – income tax. If we look at the income statement, we know that it is after we deduct the financial expense that we deduct income tax. If the company pays a lot interest, it may have no profit for income tax deduction. As a result, it may NOT need to pay for the tax anymore.

By now we are ready to come up with the result for evaluating a company’s ability to repay long-term debt interest. We can use profit before deducting interests and income tax, or earnings before interest and taxes (EBIT) as the basis.

But we shouldn’t stop there. Remember that we start out to find the ratio to evaluate a company’s ability to repay long-term debt interest.

Therefore, what we want to do is to divide EBIT by interests to get interest coverage ratio.

What interest coverage ratio stands for is the number of times that we can pay interests with EBIT. The higher the ratio, the more capable we can pay for the interests.

If we look at our fictional company, Its net profit is 5.2 million dollars, income tax 1 million dollars, and financial expense 1.3 million dollars.

Normally if we are unsure about the interest expenses, we can use financial expense as its substitute. By combining 5.2 million, 1 million, and 1.3 million, we got our EBIT value at 7.5 million dollars. If we divide EBIT by interests, which is 1.3 million dollars, we will get an interest coverage ratio of 5.8. This means what the company earns can pay interests 5.8 times. In this sense, it has strong capacity of interest payment.

Long-term debt principal repayment

Now let’s look at a company’s ability to pay principal.

The payment of principal is a long term incremental process, and we won’t have a special fund set up just for the long term debt principal payment. Therefore, the measurement of the ability won’t be accurate.

In reality, there are different ways for such evaluation but none of them are accurate. Here I would like to introduce a very rudimentary method called debt asset ratio, which is dividing total liabilities by total assets.

We can see that we are using not just long term liability but the total liability. Why can debt asset ratio help us measure our ability to repay debt principals?

The concept is fairly simple and intuitive actually. The more I borrow, the less likely I can pay for it. This ratio is quite useful in reality, and it has another name called financial leverage.

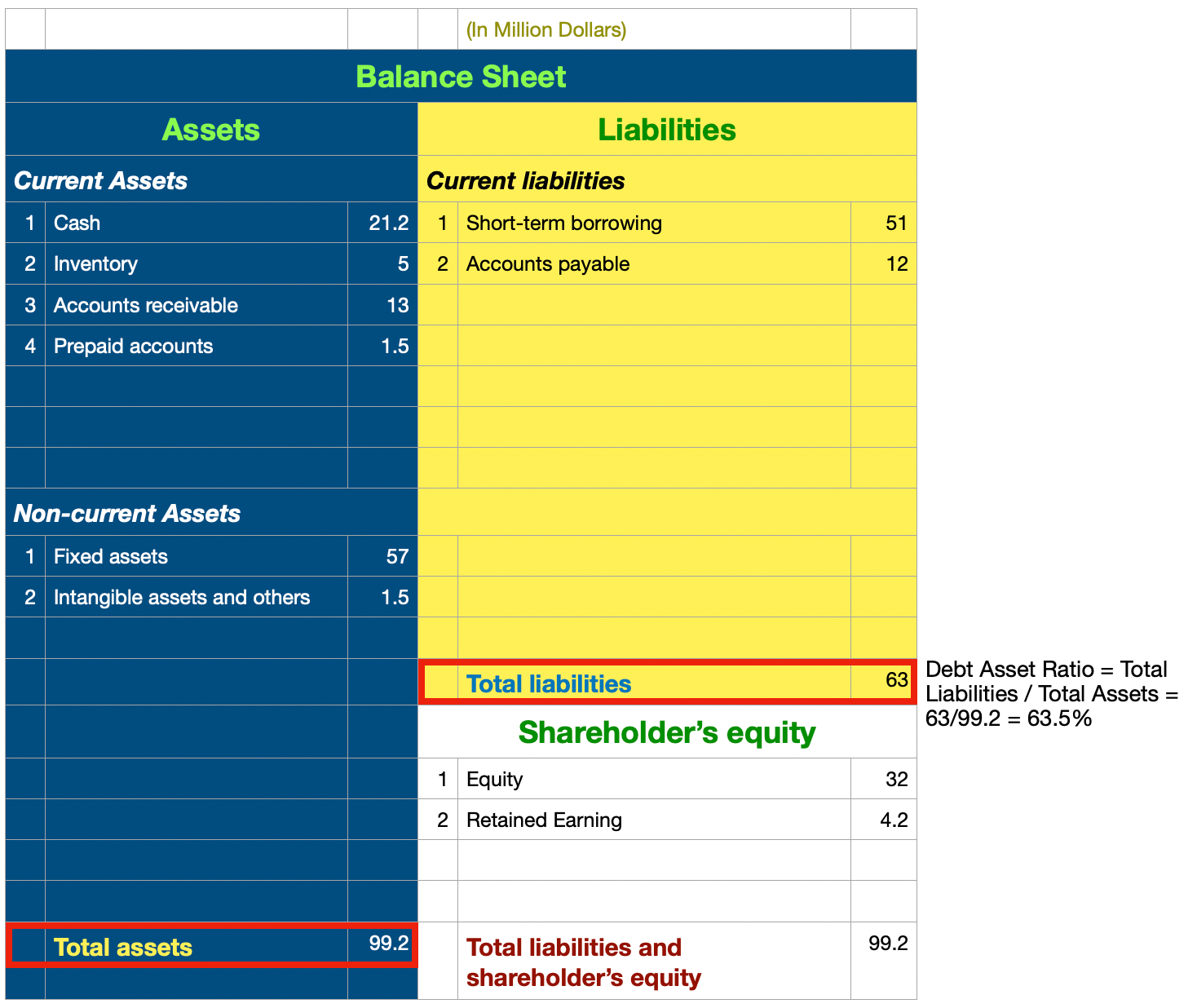

The reason we call debt asset ratio the financial leverage is that similar to how an actual leverage, it has a magnifying effect. It magnifies the fund of a company. Now what I mean by that?

If a shareholder of a company has 1 million dollars and invests that into the company without borrowing anything, that 1 million dollars will be all he has to invest and thus generate more money from business operations. However, if he borrows another 1 million dollars, he can earn money with two millions dollars instead of one. From the perspective of the shareholder, he would definitely hope that the leverage can be higher. The best scenario is that he doesn’t need to use his own money at all, and all 100% of funding comes from banks. Of course this will never happen in reality, but you get the idea.

So financial leverage is the result of compromise between the two sides, i.e. shareholders and creditors, and the result won’t be too high or too low, but somewhere in the middle. It will vary for different industries; for example, asset intensive industry will likely have higher financial leverage because companies in this industry need a large amount of money to purchase lands and fixed assets, etc. They also have larger asset base to put up as mortgage, giving them stronger borrowing powers. One such example is the airline companies. It is common that many airline companies havea debt ratio of over 80%.

What type of companies have lower ratios? Normally companies with sufficient cash flow because they don’t need to borrow lots of money. For instance, some distribution companies and asset-light companies, etc.

If we calculate the debt asset ratio of the fictional company, we can see that total asset is 99.2 million, and total liability is 63 million. By dividing 63 million by 99.2 million will get a debt ratio of 63.5%. Of course you can argue that the company doesn’t actually have long term debt at all, so our method might be inaccurate for measuring the ability to pay long term debt. This is a very good question; however, for the time being, this is still an imperfect but valid method to evaluate the company’s overall ability to repay debts.

By now we have covered common size analysis, profitability analysis, asset turnover ratios, short-term solvency analysis, and long-term solvency analysis. Because cash flow analysis has different issues from the other types of analyses, we will leave it to the last session. If you want to have a full picture recap of all the terminologies we have covered, you can find them here.

@import url(“https://assets.mlcdn.com/fonts.css?version=1714030″); /* LOADER */ .ml-form-embedSubmitLoad { display: inline-block; width: 20px; height: 20px; } .g-recaptcha { transform: scale(1); -webkit-transform: scale(1); transform-origin: 0 0; -webkit-transform-origin: 0 0; height: ; } .sr-only { position: absolute; width: 1px; height: 1px; padding: 0; margin: -1px; overflow: hidden; clip: rect(0,0,0,0); border: 0; } .ml-form-embedSubmitLoad:after { content: ” “; display: block; width: 11px; height: 11px; margin: 1px; border-radius: 50%; border: 4px solid #fff; border-color: #ffffff #ffffff #ffffff transparent; animation: ml-form-embedSubmitLoad 1.2s linear infinite; } @keyframes ml-form-embedSubmitLoad { 0% { transform: rotate(0deg); } 100% { transform: rotate(360deg); } } #mlb2-14362251.ml-form-embedContainer { box-sizing: border-box; display: table; margin: 0 auto; position: static; width: 100% !important; } #mlb2-14362251.ml-form-embedContainer h4, #mlb2-14362251.ml-form-embedContainer p, #mlb2-14362251.ml-form-embedContainer span, #mlb2-14362251.ml-form-embedContainer button { text-transform: none !important; letter-spacing: normal !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper { background-color: #f6f6f6; border-width: 0px; border-color: transparent; border-radius: 4px; border-style: solid; box-sizing: border-box; display: inline-block !important; margin: 0; padding: 0; position: relative; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper.embedPopup, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper.embedDefault { width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper.embedForm { max-width: 100%; width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-align-left { text-align: left; } #mlb2-14362251.ml-form-embedContainer .ml-form-align-center { text-align: center; } #mlb2-14362251.ml-form-embedContainer .ml-form-align-default { display: table-cell !important; vertical-align: middle !important; text-align: center !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-align-right { text-align: right; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedHeader img { border-top-left-radius: 4px; border-top-right-radius: 4px; height: auto; margin: 0 auto !important; max-width: 100%; width: 990px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody { padding: 20px 20px 0 20px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody.ml-form-embedBodyHorizontal { padding-bottom: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent { text-align: left; margin: 0 0 20px 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent h4, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent h4 { color: #1F5014; font-family: ‘Anton’, sans-serif; font-size: 30px; font-weight: 400; margin: 0 0 10px 0; text-align: center; word-break: break-word; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent p, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent p { color: #000000; font-family: ‘Palatino Linotype’, ‘Book Antiqua’, Palatino, serif; font-size: 18px; font-weight: 400; line-height: 24px; margin: 0 0 10px 0; text-align: center; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent ul, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent ol, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent ul, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent ol { color: #000000; font-family: ‘Palatino Linotype’, ‘Book Antiqua’, Palatino, serif; font-size: 18px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent ol ol, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent ol ol { list-style-type: lower-alpha; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent ol ol ol, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent ol ol ol { list-style-type: lower-roman; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent p a, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent p a { color: #000000; text-decoration: underline; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-block-form .ml-field-group { text-align: left!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-block-form .ml-field-group label { margin-bottom: 5px; color: #333333; font-size: 14px; font-family: ‘Open Sans’, Arial, Helvetica, sans-serif; font-weight: bold; font-style: normal; text-decoration: none;; display: inline-block; line-height: 20px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent p:last-child, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent p:last-child { margin: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody form { margin: 0; width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-formContent, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow { margin: 0 0 20px 0; width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow { float: left; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-formContent.horozintalForm { margin: 0; padding: 0 0 20px 0; width: 100%; height: auto; float: left; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow { margin: 0 0 10px 0; width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow.ml-last-item { margin: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow.ml-formfieldHorizintal { margin: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input { background-color: #ffffff !important; color: #333333 !important; border-color: #cccccc; border-radius: 4px !important; border-style: solid !important; border-width: 1px !important; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif; font-size: 14px !important; height: auto; line-height: 21px !important; margin-bottom: 0; margin-top: 0; margin-left: 0; margin-right: 0; padding: 10px 10px !important; width: 100% !important; box-sizing: border-box !important; max-width: 100% !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input::-webkit-input-placeholder, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow input::-webkit-input-placeholder { color: #333333; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input::-moz-placeholder, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow input::-moz-placeholder { color: #333333; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input:-ms-input-placeholder, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow input:-ms-input-placeholder { color: #333333; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input:-moz-placeholder, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow input:-moz-placeholder { color: #333333; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow textarea, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow textarea { background-color: #ffffff !important; color: #333333 !important; border-color: #cccccc; border-radius: 4px !important; border-style: solid !important; border-width: 1px !important; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif; font-size: 14px !important; height: auto; line-height: 21px !important; margin-bottom: 0; margin-top: 0; padding: 10px 10px !important; width: 100% !important; box-sizing: border-box !important; max-width: 100% !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::before { border-color: #cccccc!important; background-color: #ffffff!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input.custom-control-input[type=”checkbox”]{ box-sizing: border-box; padding: 0; position: absolute; z-index: -1; opacity: 0; margin-top: 5px; margin-left: -1.5rem; overflow: visible; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::before { border-radius: 4px!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow input[type=checkbox]:checked~.label-description::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox input[type=checkbox]:checked~.label-description::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-input:checked~.custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-input:checked~.custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox input[type=checkbox]:checked~.label-description::after { background-image: url(“data:image/svg+xml,%3csvg xmlns=’http://www.w3.org/2000/svg’ viewBox=’0 0 8 8’%3e%3cpath fill=’%23fff’ d=’M6.564.75l-3.59 3.612-1.538-1.55L0 4.26 2.974 7.25 8 2.193z’/%3e%3c/svg%3e”); } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-input:checked~.custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-input:checked~.custom-control-label::after { background-image: url(“data:image/svg+xml,%3csvg xmlns=’http://www.w3.org/2000/svg’ viewBox=’-4 -4 8 8’%3e%3ccircle r=’3′ fill=’%23fff’/%3e%3c/svg%3e”); } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-input:checked~.custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-input:checked~.custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-input:checked~.custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-input:checked~.custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox input[type=checkbox]:checked~.label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox input[type=checkbox]:checked~.label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow input[type=checkbox]:checked~.label-description::before { border-color: #000000!important; background-color: #000000!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-label::after { top: 2px; box-sizing: border-box; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::after { top: 0px!important; box-sizing: border-box!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::after { top: 0px!important; box-sizing: border-box!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::after { top: 0px!important; box-sizing: border-box!important; position: absolute; left: -1.5rem; display: block; width: 1rem; height: 1rem; content: “”; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::before { top: 0px!important; box-sizing: border-box!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .custom-control-label::before { position: absolute; top: 4px; left: -1.5rem; display: block; width: 16px; height: 16px; pointer-events: none; content: “”; background-color: #ffffff; border: #adb5bd solid 1px; border-radius: 50%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .custom-control-label::after { position: absolute; top: 2px!important; left: -1.5rem; display: block; width: 1rem; height: 1rem; content: “”; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::before { position: absolute; top: 4px; left: -1.5rem; display: block; width: 16px; height: 16px; pointer-events: none; content: “”; background-color: #ffffff; border: #adb5bd solid 1px; border-radius: 50%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::after { position: absolute; top: 0px!important; left: -1.5rem; display: block; width: 1rem; height: 1rem; content: “”; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::after { position: absolute; top: 0px!important; left: -1.5rem; display: block; width: 1rem; height: 1rem; content: “”; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .custom-radio .custom-control-label::after { background: no-repeat 50%/50% 50%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .custom-checkbox .custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::after { background: no-repeat 50%/50% 50%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-control, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-control { position: relative; display: block; min-height: 1.5rem; padding-left: 1.5rem; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-input, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-input, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-input, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-input { position: absolute; z-index: -1; opacity: 0; box-sizing: border-box; padding: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-label, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-label, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-label, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-label { color: #000000; font-size: 12px!important; font-family: ‘Open Sans’, Arial, Helvetica, sans-serif; line-height: 22px; margin-bottom: 0; position: relative; vertical-align: top; font-style: normal; font-weight: 700; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-select, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-select { background-color: #ffffff !important; color: #333333 !important; border-color: #cccccc; border-radius: 4px !important; border-style: solid !important; border-width: 1px !important; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif; font-size: 14px !important; line-height: 20px !important; margin-bottom: 0; margin-top: 0; padding: 10px 28px 10px 12px !important; width: 100% !important; box-sizing: border-box !important; max-width: 100% !important; height: auto; display: inline-block; vertical-align: middle; background: url(‘https://assets.mlcdn.com/ml/images/default/dropdown.svg’) no-repeat right .75rem center/8px 10px; -webkit-appearance: none; -moz-appearance: none; appearance: none; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow { height: auto; width: 100%; float: left; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-input-horizontal { width: 70%; float: left; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-button-horizontal { width: 30%; float: left; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-button-horizontal.labelsOn { padding-top: 25px; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .horizontal-fields { box-sizing: border-box; float: left; padding-right: 10px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow input { background-color: #ffffff; color: #333333; border-color: #cccccc; border-radius: 4px; border-style: solid; border-width: 1px; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif; font-size: 14px; line-height: 20px; margin-bottom: 0; margin-top: 0; padding: 10px 10px; width: 100%; box-sizing: border-box; overflow-y: initial; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow button { background-color: #000000 !important; border-color: #000000; border-style: solid; border-width: 1px; border-radius: 4px; box-shadow: none; color: #ffffff !important; cursor: pointer; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif; font-size: 14px !important; font-weight: 700; line-height: 20px; margin: 0 !important; padding: 10px !important; width: 100%; height: auto; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow button:hover { background-color: #1F5014 !important; border-color: #1F5014 !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow input[type=”checkbox”] { box-sizing: border-box; padding: 0; position: absolute; z-index: -1; opacity: 0; margin-top: 5px; margin-left: -1.5rem; overflow: visible; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description { color: #000000; display: block; font-family: ‘Open Sans’, Arial, Helvetica, sans-serif; font-size: 12px; text-align: left; margin-bottom: 0; position: relative; vertical-align: top; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow label { font-weight: normal; margin: 0; padding: 0; position: relative; display: block; min-height: 24px; padding-left: 24px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow label a { color: #000000; text-decoration: underline; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow label p { color: #000000 !important; font-family: ‘Open Sans’, Arial, Helvetica, sans-serif !important; font-size: 12px !important; font-weight: normal !important; line-height: 18px !important; padding: 0 !important; margin: 0 5px 0 0 !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow label p:last-child { margin: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedSubmit { margin: 0 0 20px 0; float: left; width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedSubmit button { background-color: #000000 !important; border: none !important; border-radius: 4px !important; box-shadow: none !important; color: #ffffff !important; cursor: pointer; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif !important; font-size: 14px !important; font-weight: 700 !important; line-height: 21px !important; height: auto; padding: 10px !important; width: 100% !important; box-sizing: border-box !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedSubmit button.loading { display: none; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedSubmit button:hover { background-color: #1F5014 !important; } .ml-subscribe-close { width: 30px; height: 30px; background: url(‘https://assets.mlcdn.com/ml/images/default/modal_close.png’) no-repeat; background-size: 30px; cursor: pointer; margin-top: -10px; margin-right: -10px; position: absolute; top: 0; right: 0; } .ml-error input, .ml-error textarea, .ml-error select { border-color: red!important; } .ml-error .custom-checkbox-radio-list { border: 1px solid red !important; border-radius: 4px; padding: 10px; } .ml-error .label-description, .ml-error .label-description p, .ml-error .label-description p a, .ml-error label:first-child { color: #ff0000 !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow.ml-error .label-description p, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow.ml-error .label-description p:first-letter { color: #ff0000 !important; } @media only screen and (max-width: 400px){ .ml-form-embedWrapper.embedDefault, .ml-form-embedWrapper.embedPopup { width: 100%!important; } .ml-form-formContent.horozintalForm { float: left!important; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow { height: auto!important; width: 100%!important; float: left!important; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-input-horizontal { width: 100%!important; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-input-horizontal > div { padding-right: 0px!important; padding-bottom: 10px; } .ml-form-formContent.horozintalForm .ml-button-horizontal { width: 100%!important; } .ml-form-formContent.horozintalForm .ml-button-horizontal.labelsOn { padding-top: 0px!important; } } .ml-mobileButton-horizontal { display: none; } #mlb2-14362251 .ml-mobileButton-horizontal button { background-color: #000000 !important; border-color: #000000 !important; border-style: solid !important; border-width: 1px !important; border-radius: 4px !important; box-shadow: none !important; color: #ffffff !important; cursor: pointer; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif !important; font-size: 14px !important; font-weight: 700 !important; line-height: 20px !important; padding: 10px !important; width: 100% !important; } @media only screen and (max-width: 400px) { #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-formContent.horozintalForm { padding: 0 0 10px 0 !important; } .ml-hide-horizontal { display: none !important; } .ml-form-formContent.horozintalForm .ml-button-horizontal { display: none!important; } .ml-mobileButton-horizontal { display: inline-block !important; margin-bottom: 20px;width:100%; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-input-horizontal > div { padding-bottom: 0px !important; } } @media only screen and (max-width: 400px) { .ml-form-formContent.horozintalForm .ml-form-horizontalRow .horizontal-fields { margin-bottom: 10px !important; width: 100% !important; } }function ml_webform_success_14362251() { var $ = ml_jQuery || jQuery; $(‘.ml-subscribe-form-14362251 .row-success’).show(); $(‘.ml-subscribe-form-14362251 .row-form’).hide(); } fetch(“https://assets.mailerlite.com/jsonp/918262/forms/119753320103413631/takel”)

Leave a Reply