The foundation for any financial analysis is financial statements.

You might have heard about the three financial statements, which are Balance Sheet, Income Statement, and Cash Flow Statement.

However, do you know why most countries require companies to prepare these three particular financial statements, not something else?

To answer this question, let’s think about why we need financial statements at all.

We prepare financial statements to describe the economic activities of a company. A company may carry out many economic activities. Depending on the industries, companies could look very different from the outside.

How can we describe these economic activities in a clear fashion, regardless of their size, industry, or even country of residence?

First, let’s think about this: what kind of economic activities take place in a company?

Economic Activities in a Company

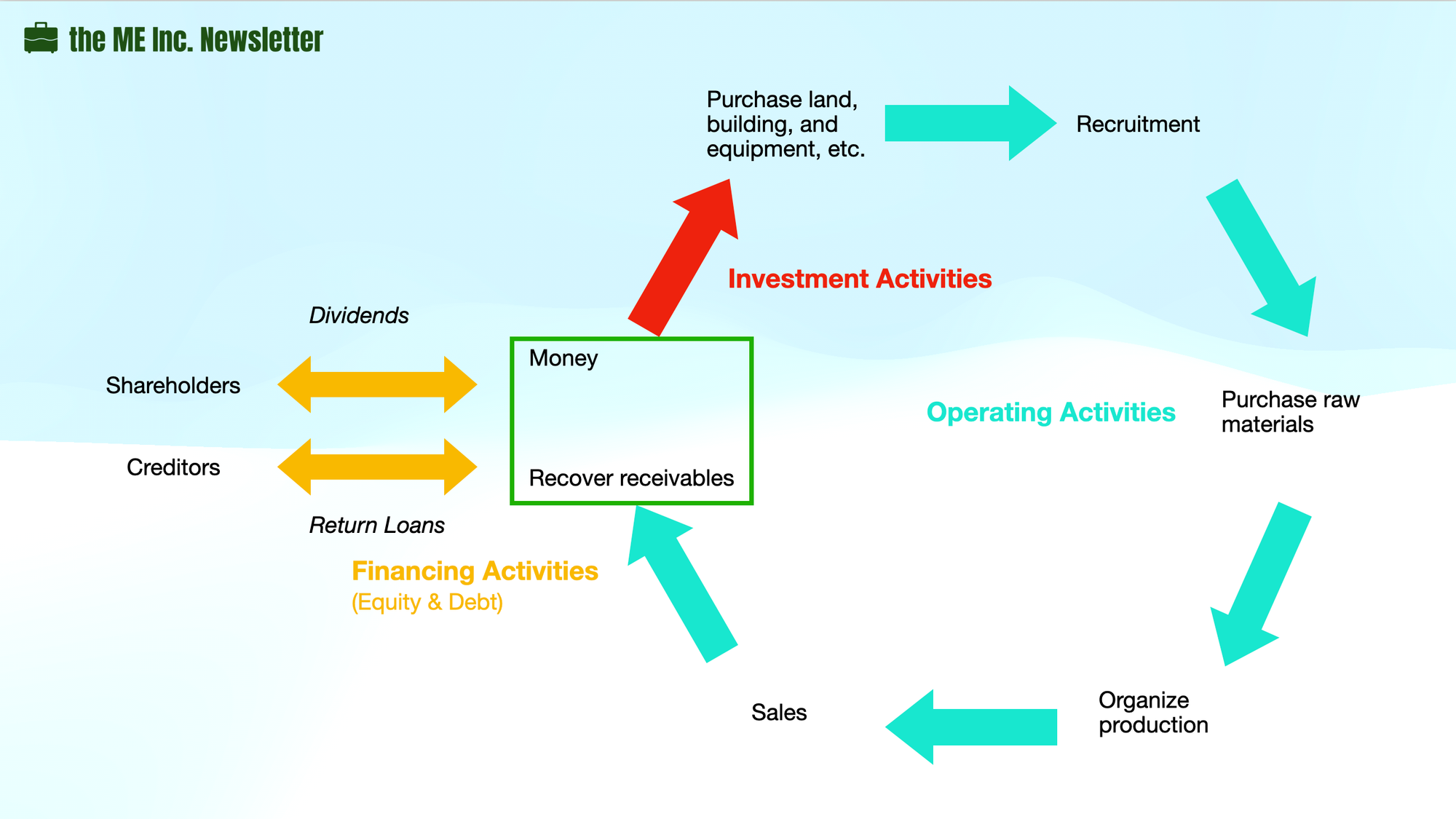

From the perspective of accounting, there are only three kinds of economic activities, which are operating activities, investment activities, and financing activities.

The first type is operating activity.

What are operating activities? In short, operating activities describe how a manufacturer produces products, sell the products, and collect receivables every day, i.e. the core of why the business exists.

The second type is investment activity.

What are investment activities? Well, a firm may open a new office, enter a new area of business, or develop a new product line. These activities are currently outside of the business’s core economic activities, and would normally require new capital injections.

During the process of operation and investment, if the firm lacks capital, it may choose to borrow from banks,

or raise money from external investment firms such as venture capitals. These are financing activities.

There might be thousands of transactions happening every year, all of them will find a place in any of the three economic activities.

Next, let’s look at how these activities take place in a company.

Let’s say that I want to start a company. The first thing I need to do is to establish a business entity, i.e. register the new company as a standalone business entity. Once the business entity is registered, my new company is formed.

At this moment, all my company has is a pile of money – the initial capital injected from my personal bank account to the company’s bank account.

Therefore we could say that the starting point of all companies is a sum of invested funds.

However, I’m not simply moving funds just for the sake of depositing it into a bank; I want the company to make a profit.

Suppose I want to set up a factory. Obviously the first thing I have to do is to build the factory plant and purchase the equipment. After having all the infrastructures established, I will need to purchase raw materials and hire staff. Now that I have secured the plant, equipment, technology, workers, and raw materials, I can start making products.

And I must be able sell my products to earn revenues – my ultimate goal.

When I sell products, more often than not, I will not able to receive cash right away. All I got is a bunch of account receivable – the right to receive cash from the buyer at a later time.

When I do receive the sales proceeds in cash, I can then use it to pay down bank loans, or pay dividends to shareholders.

The Repeating Cycle

Every company’s economic activities can be abstracted into this constantly repeating cycle, regardless of industry, specific business, and developmental stage. This cycle starts with invested funds in cash and ends with received sales proceeds in cash. Now let’s examine if the above three economic activities have happened during the cycle.

When I start the company, I may not be able to provide all the initial investment by myself. Instead, I may need to borrow money from the bank.

This is obviously a financing activity.

Then I take the invested funds to build factory plant, purchase equipment, and may subsequently invest into other companies, or establish a joint venture with someone else.

All of the above are investment activities.

Once I have all the infrastructures set up, I will purchase raw materials, produce goods, market products, and receive cash from sales. This process repeats over and over.

These are operating activities.

Why We Need Financial Statements

My goal for starting a company is to make money, or generating cash, and I want to receive more cash than my invested cash. A company that achieves this goal is making a profit.

However, only answering this question is not enough. An even more fundamental question is: what happened to the principal of my investment? Though I don’t want to see my company losing money from operating activities, I definitely don’t want to lose my initial investment.

If you can recall, my company’s initial form is just a pile of cash, lying in the company’s bank account. However, after investing in all kinds of infrastructure, the pile of cash – or the principle of investment – is transformed into varies kinds of stuff such as fixed assets. In this process, it’s important that I understand what my initial investment has become, and how much it is still worth.

That is what Balance Sheet will tell me.

Income Statement and Cash Flow Statement serve other purposes in similar fashion. By examining all three statements and their interrelations, I can draw insights for my company that I wouldn’t be able to otherwise.

@import url(“https://assets.mlcdn.com/fonts.css?version=1714030″); /* LOADER */ .ml-form-embedSubmitLoad { display: inline-block; width: 20px; height: 20px; } .g-recaptcha { transform: scale(1); -webkit-transform: scale(1); transform-origin: 0 0; -webkit-transform-origin: 0 0; height: ; } .sr-only { position: absolute; width: 1px; height: 1px; padding: 0; margin: -1px; overflow: hidden; clip: rect(0,0,0,0); border: 0; } .ml-form-embedSubmitLoad:after { content: ” “; display: block; width: 11px; height: 11px; margin: 1px; border-radius: 50%; border: 4px solid #fff; border-color: #ffffff #ffffff #ffffff transparent; animation: ml-form-embedSubmitLoad 1.2s linear infinite; } @keyframes ml-form-embedSubmitLoad { 0% { transform: rotate(0deg); } 100% { transform: rotate(360deg); } } #mlb2-14362251.ml-form-embedContainer { box-sizing: border-box; display: table; margin: 0 auto; position: static; width: 100% !important; } #mlb2-14362251.ml-form-embedContainer h4, #mlb2-14362251.ml-form-embedContainer p, #mlb2-14362251.ml-form-embedContainer span, #mlb2-14362251.ml-form-embedContainer button { text-transform: none !important; letter-spacing: normal !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper { background-color: #f6f6f6; border-width: 0px; border-color: transparent; border-radius: 4px; border-style: solid; box-sizing: border-box; display: inline-block !important; margin: 0; padding: 0; position: relative; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper.embedPopup, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper.embedDefault { width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper.embedForm { max-width: 100%; width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-align-left { text-align: left; } #mlb2-14362251.ml-form-embedContainer .ml-form-align-center { text-align: center; } #mlb2-14362251.ml-form-embedContainer .ml-form-align-default { display: table-cell !important; vertical-align: middle !important; text-align: center !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-align-right { text-align: right; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedHeader img { border-top-left-radius: 4px; border-top-right-radius: 4px; height: auto; margin: 0 auto !important; max-width: 100%; width: 990px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody { padding: 20px 20px 0 20px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody.ml-form-embedBodyHorizontal { padding-bottom: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent { text-align: left; margin: 0 0 20px 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent h4, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent h4 { color: #1F5014; font-family: ‘Anton’, sans-serif; font-size: 30px; font-weight: 400; margin: 0 0 10px 0; text-align: center; word-break: break-word; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent p, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent p { color: #000000; font-family: ‘Palatino Linotype’, ‘Book Antiqua’, Palatino, serif; font-size: 18px; font-weight: 400; line-height: 24px; margin: 0 0 10px 0; text-align: center; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent ul, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent ol, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent ul, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent ol { color: #000000; font-family: ‘Palatino Linotype’, ‘Book Antiqua’, Palatino, serif; font-size: 18px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent ol ol, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent ol ol { list-style-type: lower-alpha; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent ol ol ol, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent ol ol ol { list-style-type: lower-roman; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent p a, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent p a { color: #000000; text-decoration: underline; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-block-form .ml-field-group { text-align: left!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-block-form .ml-field-group label { margin-bottom: 5px; color: #333333; font-size: 14px; font-family: ‘Open Sans’, Arial, Helvetica, sans-serif; font-weight: bold; font-style: normal; text-decoration: none;; display: inline-block; line-height: 20px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedContent p:last-child, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-successBody .ml-form-successContent p:last-child { margin: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody form { margin: 0; width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-formContent, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow { margin: 0 0 20px 0; width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow { float: left; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-formContent.horozintalForm { margin: 0; padding: 0 0 20px 0; width: 100%; height: auto; float: left; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow { margin: 0 0 10px 0; width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow.ml-last-item { margin: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow.ml-formfieldHorizintal { margin: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input { background-color: #ffffff !important; color: #333333 !important; border-color: #cccccc; border-radius: 4px !important; border-style: solid !important; border-width: 1px !important; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif; font-size: 14px !important; height: auto; line-height: 21px !important; margin-bottom: 0; margin-top: 0; margin-left: 0; margin-right: 0; padding: 10px 10px !important; width: 100% !important; box-sizing: border-box !important; max-width: 100% !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input::-webkit-input-placeholder, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow input::-webkit-input-placeholder { color: #333333; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input::-moz-placeholder, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow input::-moz-placeholder { color: #333333; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input:-ms-input-placeholder, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow input:-ms-input-placeholder { color: #333333; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input:-moz-placeholder, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow input:-moz-placeholder { color: #333333; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow textarea, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow textarea { background-color: #ffffff !important; color: #333333 !important; border-color: #cccccc; border-radius: 4px !important; border-style: solid !important; border-width: 1px !important; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif; font-size: 14px !important; height: auto; line-height: 21px !important; margin-bottom: 0; margin-top: 0; padding: 10px 10px !important; width: 100% !important; box-sizing: border-box !important; max-width: 100% !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::before { border-color: #cccccc!important; background-color: #ffffff!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow input.custom-control-input[type=”checkbox”]{ box-sizing: border-box; padding: 0; position: absolute; z-index: -1; opacity: 0; margin-top: 5px; margin-left: -1.5rem; overflow: visible; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::before { border-radius: 4px!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow input[type=checkbox]:checked~.label-description::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox input[type=checkbox]:checked~.label-description::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-input:checked~.custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-input:checked~.custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox input[type=checkbox]:checked~.label-description::after { background-image: url(“data:image/svg+xml,%3csvg xmlns=’http://www.w3.org/2000/svg’ viewBox=’0 0 8 8’%3e%3cpath fill=’%23fff’ d=’M6.564.75l-3.59 3.612-1.538-1.55L0 4.26 2.974 7.25 8 2.193z’/%3e%3c/svg%3e”); } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-input:checked~.custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-input:checked~.custom-control-label::after { background-image: url(“data:image/svg+xml,%3csvg xmlns=’http://www.w3.org/2000/svg’ viewBox=’-4 -4 8 8’%3e%3ccircle r=’3′ fill=’%23fff’/%3e%3c/svg%3e”); } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-input:checked~.custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-input:checked~.custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-input:checked~.custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-input:checked~.custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox input[type=checkbox]:checked~.label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox input[type=checkbox]:checked~.label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow input[type=checkbox]:checked~.label-description::before { border-color: #000000!important; background-color: #000000!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-label::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-label::after { top: 2px; box-sizing: border-box; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::after { top: 0px!important; box-sizing: border-box!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::after { top: 0px!important; box-sizing: border-box!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::after { top: 0px!important; box-sizing: border-box!important; position: absolute; left: -1.5rem; display: block; width: 1rem; height: 1rem; content: “”; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::before { top: 0px!important; box-sizing: border-box!important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .custom-control-label::before { position: absolute; top: 4px; left: -1.5rem; display: block; width: 16px; height: 16px; pointer-events: none; content: “”; background-color: #ffffff; border: #adb5bd solid 1px; border-radius: 50%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .custom-control-label::after { position: absolute; top: 2px!important; left: -1.5rem; display: block; width: 1rem; height: 1rem; content: “”; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::before, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::before { position: absolute; top: 4px; left: -1.5rem; display: block; width: 16px; height: 16px; pointer-events: none; content: “”; background-color: #ffffff; border: #adb5bd solid 1px; border-radius: 50%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::after { position: absolute; top: 0px!important; left: -1.5rem; display: block; width: 1rem; height: 1rem; content: “”; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::after { position: absolute; top: 0px!important; left: -1.5rem; display: block; width: 1rem; height: 1rem; content: “”; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .custom-radio .custom-control-label::after { background: no-repeat 50%/50% 50%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .custom-checkbox .custom-control-label::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedPermissions .ml-form-embedPermissionsOptionsCheckbox .label-description::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-interestGroupsRow .ml-form-interestGroupsRowCheckbox .label-description::after, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description::after { background: no-repeat 50%/50% 50%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-control, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-control { position: relative; display: block; min-height: 1.5rem; padding-left: 1.5rem; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-input, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-input, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-input, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-input { position: absolute; z-index: -1; opacity: 0; box-sizing: border-box; padding: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-radio .custom-control-label, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-radio .custom-control-label, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-checkbox .custom-control-label, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-checkbox .custom-control-label { color: #000000; font-size: 12px!important; font-family: ‘Open Sans’, Arial, Helvetica, sans-serif; line-height: 22px; margin-bottom: 0; position: relative; vertical-align: top; font-style: normal; font-weight: 700; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-fieldRow .custom-select, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow .custom-select { background-color: #ffffff !important; color: #333333 !important; border-color: #cccccc; border-radius: 4px !important; border-style: solid !important; border-width: 1px !important; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif; font-size: 14px !important; line-height: 20px !important; margin-bottom: 0; margin-top: 0; padding: 10px 28px 10px 12px !important; width: 100% !important; box-sizing: border-box !important; max-width: 100% !important; height: auto; display: inline-block; vertical-align: middle; background: url(‘https://assets.mlcdn.com/ml/images/default/dropdown.svg’) no-repeat right .75rem center/8px 10px; -webkit-appearance: none; -moz-appearance: none; appearance: none; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow { height: auto; width: 100%; float: left; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-input-horizontal { width: 70%; float: left; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-button-horizontal { width: 30%; float: left; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-button-horizontal.labelsOn { padding-top: 25px; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .horizontal-fields { box-sizing: border-box; float: left; padding-right: 10px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow input { background-color: #ffffff; color: #333333; border-color: #cccccc; border-radius: 4px; border-style: solid; border-width: 1px; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif; font-size: 14px; line-height: 20px; margin-bottom: 0; margin-top: 0; padding: 10px 10px; width: 100%; box-sizing: border-box; overflow-y: initial; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow button { background-color: #000000 !important; border-color: #000000; border-style: solid; border-width: 1px; border-radius: 4px; box-shadow: none; color: #ffffff !important; cursor: pointer; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif; font-size: 14px !important; font-weight: 700; line-height: 20px; margin: 0 !important; padding: 10px !important; width: 100%; height: auto; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-horizontalRow button:hover { background-color: #1F5014 !important; border-color: #1F5014 !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow input[type=”checkbox”] { box-sizing: border-box; padding: 0; position: absolute; z-index: -1; opacity: 0; margin-top: 5px; margin-left: -1.5rem; overflow: visible; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow .label-description { color: #000000; display: block; font-family: ‘Open Sans’, Arial, Helvetica, sans-serif; font-size: 12px; text-align: left; margin-bottom: 0; position: relative; vertical-align: top; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow label { font-weight: normal; margin: 0; padding: 0; position: relative; display: block; min-height: 24px; padding-left: 24px; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow label a { color: #000000; text-decoration: underline; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow label p { color: #000000 !important; font-family: ‘Open Sans’, Arial, Helvetica, sans-serif !important; font-size: 12px !important; font-weight: normal !important; line-height: 18px !important; padding: 0 !important; margin: 0 5px 0 0 !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow label p:last-child { margin: 0; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedSubmit { margin: 0 0 20px 0; float: left; width: 100%; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedSubmit button { background-color: #000000 !important; border: none !important; border-radius: 4px !important; box-shadow: none !important; color: #ffffff !important; cursor: pointer; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif !important; font-size: 14px !important; font-weight: 700 !important; line-height: 21px !important; height: auto; padding: 10px !important; width: 100% !important; box-sizing: border-box !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedSubmit button.loading { display: none; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-embedSubmit button:hover { background-color: #1F5014 !important; } .ml-subscribe-close { width: 30px; height: 30px; background: url(‘https://assets.mlcdn.com/ml/images/default/modal_close.png’) no-repeat; background-size: 30px; cursor: pointer; margin-top: -10px; margin-right: -10px; position: absolute; top: 0; right: 0; } .ml-error input, .ml-error textarea, .ml-error select { border-color: red!important; } .ml-error .custom-checkbox-radio-list { border: 1px solid red !important; border-radius: 4px; padding: 10px; } .ml-error .label-description, .ml-error .label-description p, .ml-error .label-description p a, .ml-error label:first-child { color: #ff0000 !important; } #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow.ml-error .label-description p, #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-checkboxRow.ml-error .label-description p:first-letter { color: #ff0000 !important; } @media only screen and (max-width: 400px){ .ml-form-embedWrapper.embedDefault, .ml-form-embedWrapper.embedPopup { width: 100%!important; } .ml-form-formContent.horozintalForm { float: left!important; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow { height: auto!important; width: 100%!important; float: left!important; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-input-horizontal { width: 100%!important; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-input-horizontal > div { padding-right: 0px!important; padding-bottom: 10px; } .ml-form-formContent.horozintalForm .ml-button-horizontal { width: 100%!important; } .ml-form-formContent.horozintalForm .ml-button-horizontal.labelsOn { padding-top: 0px!important; } } .ml-mobileButton-horizontal { display: none; } #mlb2-14362251 .ml-mobileButton-horizontal button { background-color: #000000 !important; border-color: #000000 !important; border-style: solid !important; border-width: 1px !important; border-radius: 4px !important; box-shadow: none !important; color: #ffffff !important; cursor: pointer; font-family: ‘Lucida Sans Unicode’, ‘Lucida Grande’, sans-serif !important; font-size: 14px !important; font-weight: 700 !important; line-height: 20px !important; padding: 10px !important; width: 100% !important; } @media only screen and (max-width: 400px) { #mlb2-14362251.ml-form-embedContainer .ml-form-embedWrapper .ml-form-embedBody .ml-form-formContent.horozintalForm { padding: 0 0 10px 0 !important; } .ml-hide-horizontal { display: none !important; } .ml-form-formContent.horozintalForm .ml-button-horizontal { display: none!important; } .ml-mobileButton-horizontal { display: inline-block !important; margin-bottom: 20px;width:100%; } .ml-form-formContent.horozintalForm .ml-form-horizontalRow .ml-input-horizontal > div { padding-bottom: 0px !important; } } @media only screen and (max-width: 400px) { .ml-form-formContent.horozintalForm .ml-form-horizontalRow .horizontal-fields { margin-bottom: 10px !important; width: 100% !important; } }function ml_webform_success_14362251() { var $ = ml_jQuery || jQuery; $(‘.ml-subscribe-form-14362251 .row-success’).show(); $(‘.ml-subscribe-form-14362251 .row-form’).hide(); } fetch(“https://assets.mailerlite.com/jsonp/918262/forms/119753320103413631/takel”)

Leave a Reply